Digital Infrastructure: The New Core Asset Class for a Data-Hungry World

From Niche to Core

In 2025, digital infrastructure has shifted from niche allocation to core portfolio holding for institutional investors. Once grouped under the broader umbrella of infrastructure, data centers, fiber networks, and cloud systems are now commanding their own dedicated funds.

Driven by the twin forces of AI adoption and cloud expansion, global fundraising in this category has reached record levels, surpassing $250 billion in commitments this year alone.

Explosive Fundraising Growth

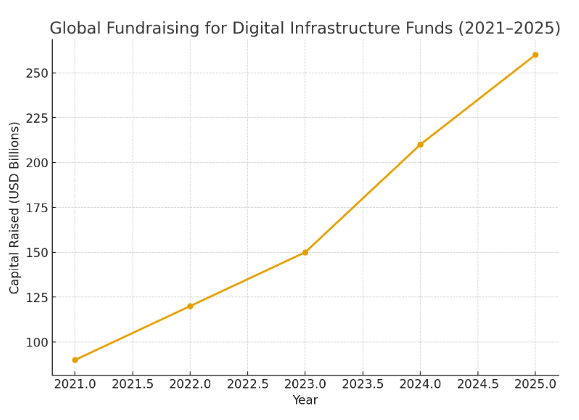

The numbers tell the story:

-

In 2021, digital infrastructure funds raised under $100 billion.

-

By 2024, commitments had more than doubled.

-

In 2025, global fundraising is projected to hit $260 billion, a nearly 3x increase in four years.

How Capital Is Being Allocated

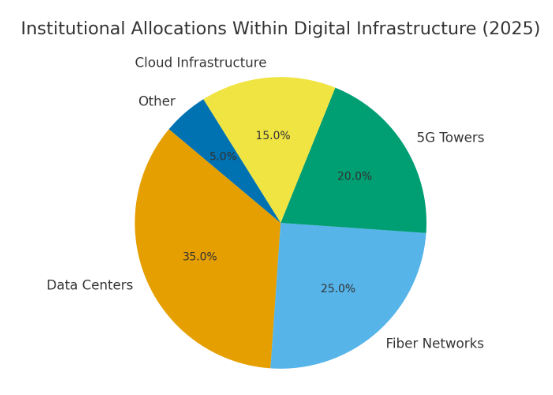

Institutional allocators are dividing commitments across subsectors, with data centers taking the lion's share.

-

Data Centers (35%) – The backbone of AI, cloud computing, and digital services.

-

Fiber Networks (25%) – Essential for bandwidth and connectivity expansion.

-

5G Towers (20%) – A critical enabler for mobile, IoT, and edge computing.

-

Cloud Infrastructure (15%) – Supporting hyperscalers and enterprise adoption.

-

Other (5%) – Includes satellite connectivity and experimental infrastructure.

Why Digital Infrastructure Is Booming

-

The AI Surge

-

Training large language models and running AI applications requires enormous computing power.

-

Demand for GPU-driven data centers has outstripped supply, drawing both private and sovereign investors.

-

-

Cloud Expansion

-

Enterprise migration to cloud services remains robust.

-

Hyperscale providers (AWS, Azure, Google Cloud) are signing long-term leases, offering investors stable cash flows.

-

-

Policy Tailwinds

-

Governments are classifying digital infrastructure as "critical national infrastructure."

-

Incentives and subsidies, particularly in Europe and Asia, are catalyzing fund inflows.

-

-

Resilience & Inflation Protection

-

Long-term contracts and inflation-linked pricing provide downside protection.

-

For investors, digital infra offers both yield stability and growth exposure.

-

Investor Dynamics: Who's Leading the Charge

-

Mega-Managers like Blackstone, Brookfield, and KKR have each raised multi-billion-dollar digital infra vehicles.

-

Sovereign Wealth Funds (notably in the Middle East and Asia) are making direct investments in data center operators.

-

Pension Funds are increasing allocations, viewing digital infra as a natural complement to energy and transport holdings.

Risks on the Horizon

Despite optimism, challenges remain:

-

Energy Intensity: Data centers are major consumers of electricity, raising ESG scrutiny.

-

Geopolitical Tensions: Control of fiber networks and cloud assets is increasingly politicized.

-

Valuation Pressure: Capital inflows risk overheating segments of the market, especially Tier 1 urban data centers.

Conclusion: A New Core Asset Class

What railroads and highways were in the 20th century, digital infrastructure is in the 21st. The sector's growth trajectory, policy support, and indispensability in a data-driven economy have elevated it to a core allocation for institutional investors.

Far from being an opportunistic play, digital infrastructure is now a strategic foundation for long-term portfolios, balancing yield stability with growth exposure.

Subscribe for updates

By providing your email, you agree to receive updates, onboarding information, and other communications related to accessing our platform.